EU VAT woes? Bandcamp musicians, you’re (probably) doing it wrong…

…but it’s not your fault, and I’m here to help. TAX DOESN’T HAVE TO BE TAXING (apparently…)!

[Last edited 15/10/21 after input from kind tweeters – I feel this may be a document that grows!]

This article will be most useful if you are:

- A UK-based, non-VAT registered musician selling your wares to music fans in EU countries via Bandcamp.

It will also be some help if you are:

- A musician based in a non-EU country besides the UK selling via Bandcamp.

- A UK-based, non-VAT registered person selling things via Etsy / eBay / any other platform that has agreed to act as a Marketplace and collect VAT from your customers on your behalf.

Why should I care? I’m busy just trying to get through the day!

Me too, me too. BUT, if you don’t do this properly, your customers will probably get charged VAT twice. When they pay VAT at checkout, they’re charged between around 20-28% of the order value (depending on their country), but when they get charged on delivery it can be quite a lot more. That sucks on its own, but if they’ve already paid the VAT they’re going to be, rightly, annoyed.

Please note: I am pretty handy at a lot of things, but I’m not a VAT expert, an accountant or a financial advisor. I’ve read a lot of quite boring articles in recent weeks in an attempt to get my head around this issue and make sure I’m doing things properly, and it’s annoyed me so much that this information was so hard to find that I’m collecting it here to save you the headache.

I’m not going to wang on about every detail, I’ll just share the pertinent facts so you can make sure your customers won’t get charged twice for VAT.

Caveats complete, let’s get started.

VAT? What? Why? Who? How?

In July 2021 the VAT laws changed. Prior to Brexit, sending a merch order from the UK to Germany wasn’t considered an import, because we were all part of the EU (oh, happy times). Now the same merch order is considered to be an import, and VAT needs to be paid.

You might remember that back in late 2014/15, the rules changed so that people in certain countries had to pay VAT on digital goods, and Bandcamp kindly stepped in and agreed to deal with that for everyone selling through them.

This year, they agreed to do the same for physical goods. Thank goodness! If they hadn’t, I would have had to register for VAT in the UK (regardless of turnover) in order to be able to sign up for the IOSS scheme to charge VAT on EU orders sold to the EU. If that sentence made your brain freeze you should be especially grateful that Bandcamp are helping us out…

BUT there’s a gap!

Connecting the dots…

Unlike other platforms acting as “Marketplaces” e.g. eBay and Etsy, Bandcamp didn’t send any information out to us sellers to explain how the system works, and to let us know that we need to connect the dots for the postal system.

This did annoy me. I’ve been selling music and merch through Bandcamp since 2009, and I’d hoped for more guidance. Bandcamp are brilliant, they offer such a wonderful service for us and I still love them very much, but this didn’t need to be so difficult.

As I have my own Shopify shop as well, I knew I needed to read up on the new VAT rules to make sure I was doing things right over there, and it was only while doing so I discovered the aforementioned Bandcamp gap.

Skip this paragraph if you’re only selling through Bandcamp or another Marketplace. If you’re running your own shop, you can still sell physical goods direct to EU customers from your own shop e.g. Shopify / Squarespace etc BUT if you’re not VAT registered you can’t collect the VAT at checkout (because that would be illegal) which means the customer has to pay at their end when the order arrives. You cannot sell digital goods direct to EU customers from your own shop, though. I’m trying to find a service to plug in to my Shopify checkout which will act as a Marketplace a la Bandcamp etc so I can sell digital and physical goods and get the VAT dealt with but I haven’t found one yet. And of course there’s a limit to how much you can make without having to register for VAT in European countries (€10,000) as there is for the UK (£85,000).

OK, back to Bandcamp: at the end of September I got in touch with Bandcamp support and started trying to get to the bottom of the whole thing, and I received very little assistance from them. After the aforementioned hours of reading boring articles about the IOSS system, I figured it out and told Bandcamp I thought they should get in touch with everyone to explain this.

They didn’t respond, but a few days later my tweets on the matter were shared with the UK Director of the European Centre for International Political Economy.

That evening, Bandcamp sellers received this message:

“Recently, the EU implemented new rules regarding taxes on imported goods. All physical orders destined for the EU are now subject to the member country’s VAT. As a seller using Enhanced Payments (where Bandcamp processes the payments and makes payouts to your account), these taxes are automatically collected and remitted by Bandcamp at the time of sale.

Proof of this tax collection is provided by our IOSS ID, which you can find in your sales receipts and the packing slips on your Merch Orders page. This IOSS ID must be included on your package or accompanying customs forms; please check with your carrier or local post office if you have questions about implementation. Failure to include the proper tax information may result in additional tax or customs charges for your fans.”

What does that mean?

I’ve put the important bits above in bold – the main issue here is that when Bandcamp charge VAT to a customer, we the sellers have to make sure the postal carrier knows VAT has been paid, and prove it too.

How to do this will vary slightly from country to country, but surely not that much.

How to do it right (in the UK – adapt for your own country)

1) The best way of doing this is to set up a Royal Mail Click and Drop account, where you can pay for postage and print out labels and customs forms direct. The reason this is the best way, is that when your package arrives in the destination country it can easily be scanned and the IOSS number will show up.

There are two schools of thought on the next bit – some say printing the postage via Click & Drop as above is enough, because the order details will be contained within the QR code on the Royal Mail postage label BUT when I used Click & Drop I couldn’t find a place to detail the order amount, VAT paid etc. Unlike Etsy / eBay etc it’s not possible to export orders from Bandcamp to Click & Drop directly. So, without manually adding the order information in Click & Drop, if that’s even possible, I’m not confident I’m including enough information with packages.

What I’ve been doing is printing the Bandcamp packing slip showing the IOSS number and details of the VAT paid and tucking it inside a “documents enclosed” pouch, which I attach to the parcel. If I don’t do this, I can only imagine the postal carrier has to take my word for it that VAT has been paid.

Here are links for the “documents enclosed” pouches and the Avery J8169 labels I bought, though obviously feel free to shop around. These aren’t affiliate links anyway

PS – adding the Bandcamp IOSS number to your Click & Drop account is hard to figure out, so scroll down to the bottom for screenshots showing how to do that – this also applies to other Marketplaces like eBay and Etsy.

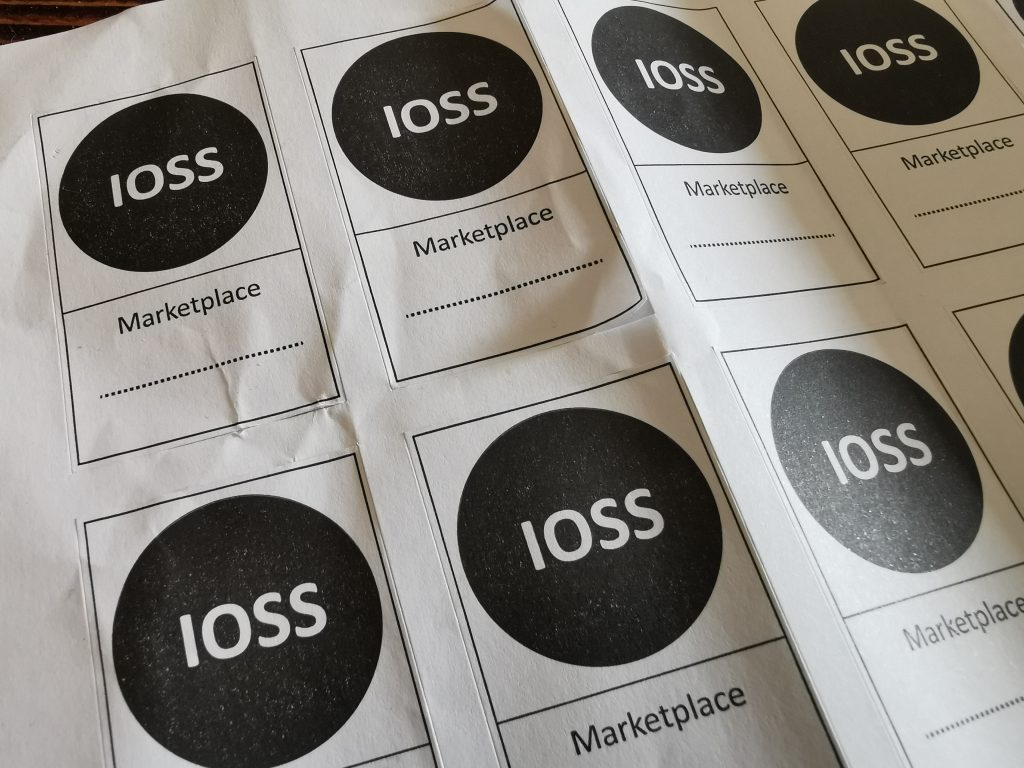

2) Another way is to write the IOSS number and the Marketplace name on the front of your parcel, as well as printing the packing slip and tucking it into a “documents enclosed” pouch on the parcel as detailed above.

When I asked about IOSS at my small local Post Office, my (very friendly and helpful) PO worker shrugged, said “this is all we’ve been told about it” and handed me a sheet of stickers to fill out and put on the front of the envelope. I think for more known platforms like eBay / Etsy you just write the name, but I would add the IOSS number on these labels as well to be sure.

I use Royal Mail’s Drop & Go service a lot, so I might try these labels, but the Click & Drop system works well now I’ve got the labels and have tried it a couple of times.

How not to do it

I read on some forums that people have just been writing the IOSS number and the Marketplace name on their packages. That’s basically the same as using the ridiculously non-official looking Royal Mail stickers above but the issue surely is that without the “documents enclosed” pouch, the postal carrier in the destination country just has to take your word for the fact that VAT has been paid. Which, let’s agree, they probably won’t. It might work, it might not. For me, this is about making absolutely sure my VIP customers don’t have to pay extra fees, so I’ll just use the documents pouch method.

How NEVER to do it

You must only use the Bandcamp IOSS number for packages sold through Bandcamp where VAT has been charged. It’s illegal to use it on packages sold through other platforms, because it’s illegal to avoid paying the VAT. We’re running legitimate businesses here, so don’t be silly.

I’ve decided to block orders from EU countries on my Shopify store because 1) I can’t charge them VAT at checkout because I’m not VAT registered, so can’t join the IOSS system directly and therefore 2) don’t want them to have to pay over the odds at their end to receive the goods. As above, it’s still legal for me to do this, but it’s not ideal. I’m going to be directing those people to buy from Bandcamp instead, because it’s moderately less of a headache now I’ve got it figured out.

Any questions / comments?

I hope you’ve found this article helpful. If you have questions, drop them below in the comments. If I’ve got this all horribly wrong, I’d love to know. I’m not pretending to be an expert, just sharing the knowledge I’ve gleaned recently. Please be polite though, because life’s too short for anything else.

If this article did help, please consider picking up some music and merch from my shop or you can buy me a digital cup of coffee via Paypal.

I share less TAXING pieces of writing on my mailing list, and you’re welcome any time.

You can also follow me around the web, on YouTube, Twitter, Instagram and Facebook.

WAIT, WE’RE NOT DONE YET!

I promised you screenshots, and I am giving you screenshots.

How to add Bandcamp’s IOSS* to your Royal Mail Click & Drop account

(And/or other Marketplace IOSS numbers of course, just set up a separate profile per Marketplace you sell through)

Wake up! I’m still talking! It’s pretty picture time anyway, we’re nearly done.

1. If you haven’t signed up for a Click & Drop account yet, here’s the link. Just call me the Royal Mail influencer *

* please don’t

Important: Royal Mail have some good How To guides here to get you started. The notes below are just about adding IOSS numbers to your account.

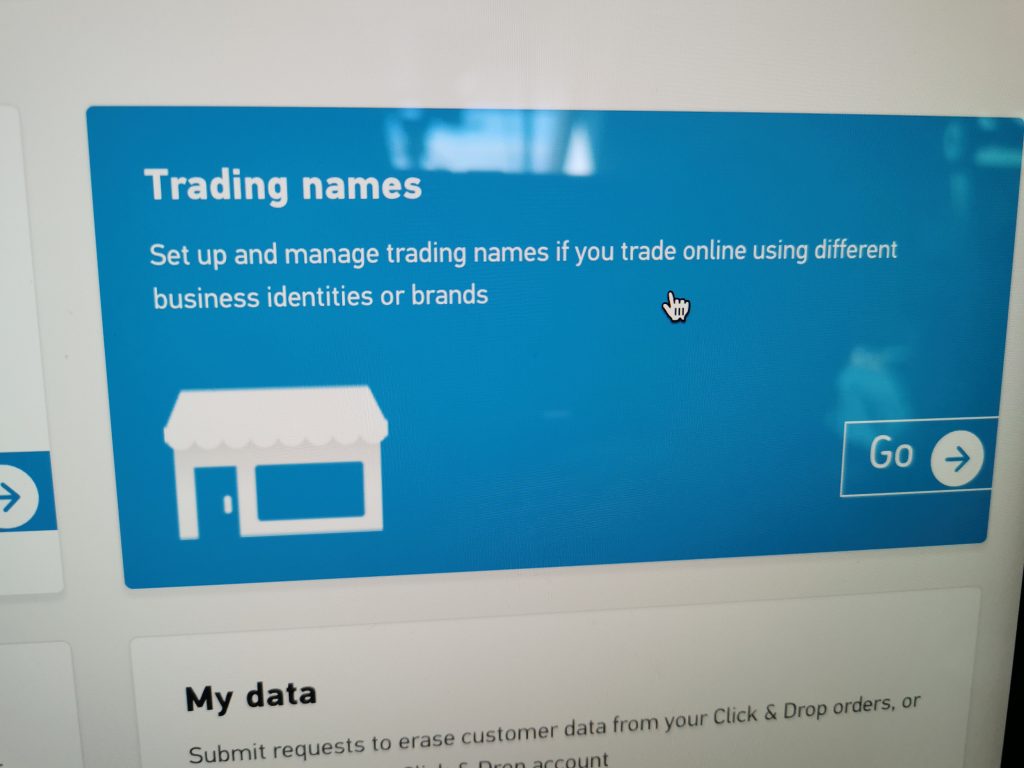

You need a separate Trading Name profile per IOSS number you use, so if you also sell to the EU via eBay / Etsy then make a separate Trading Name for each one. If you just use Bandcamp, you only need one. So…

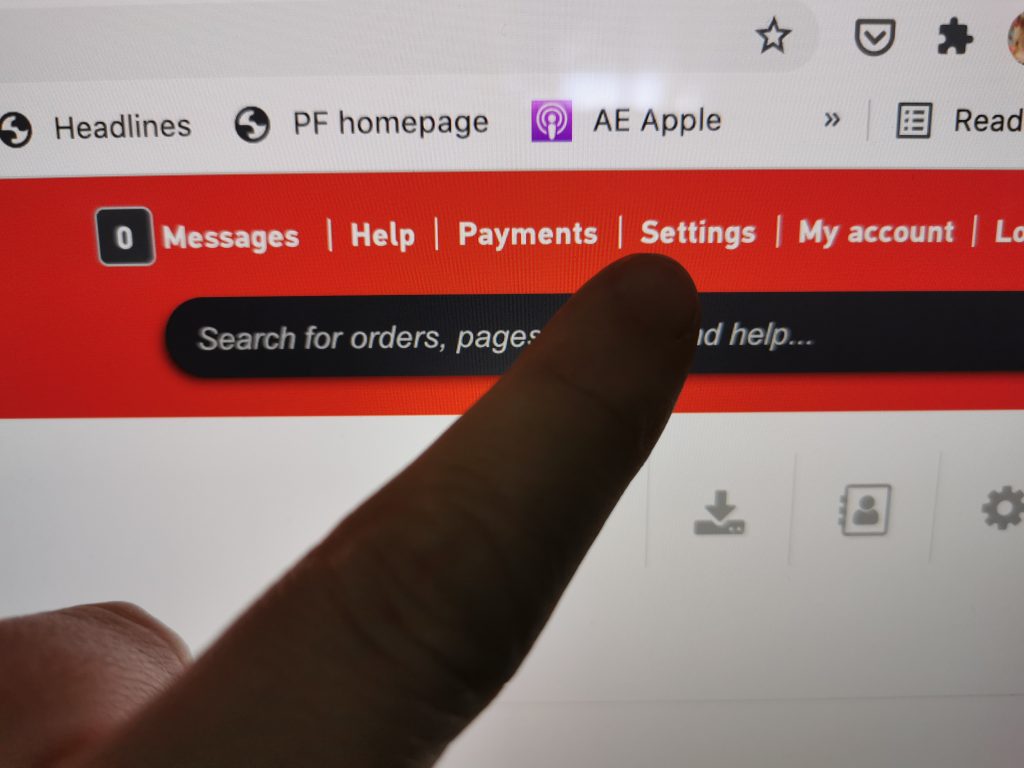

2. Go to settings.

3. Click on Trading names.

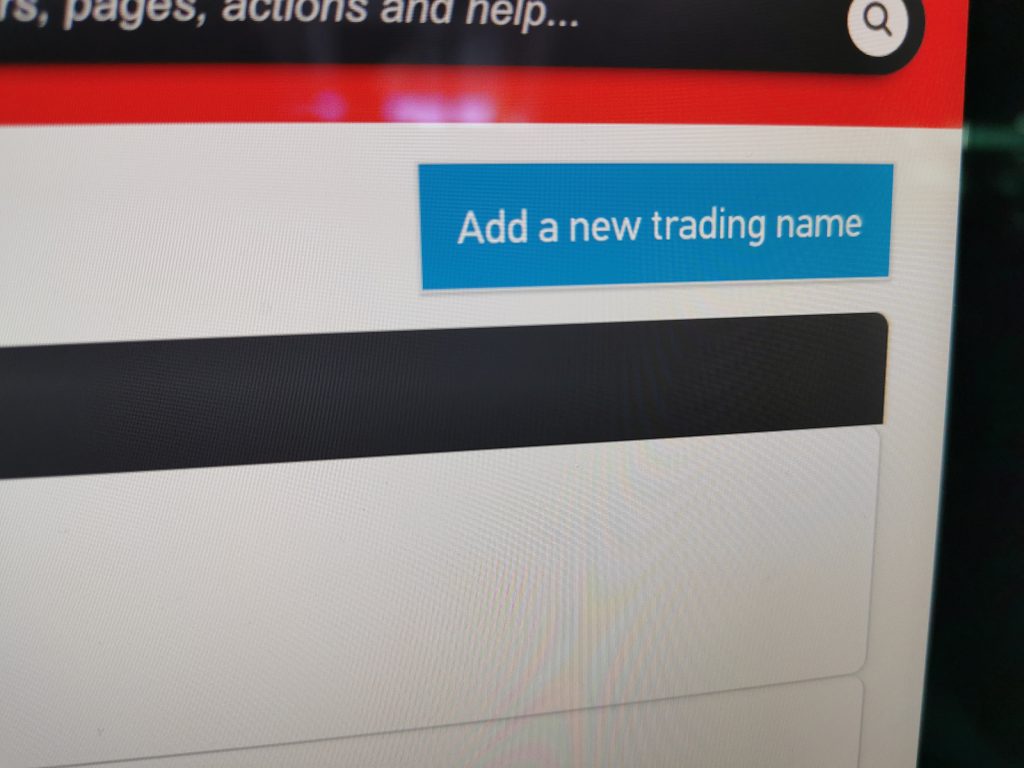

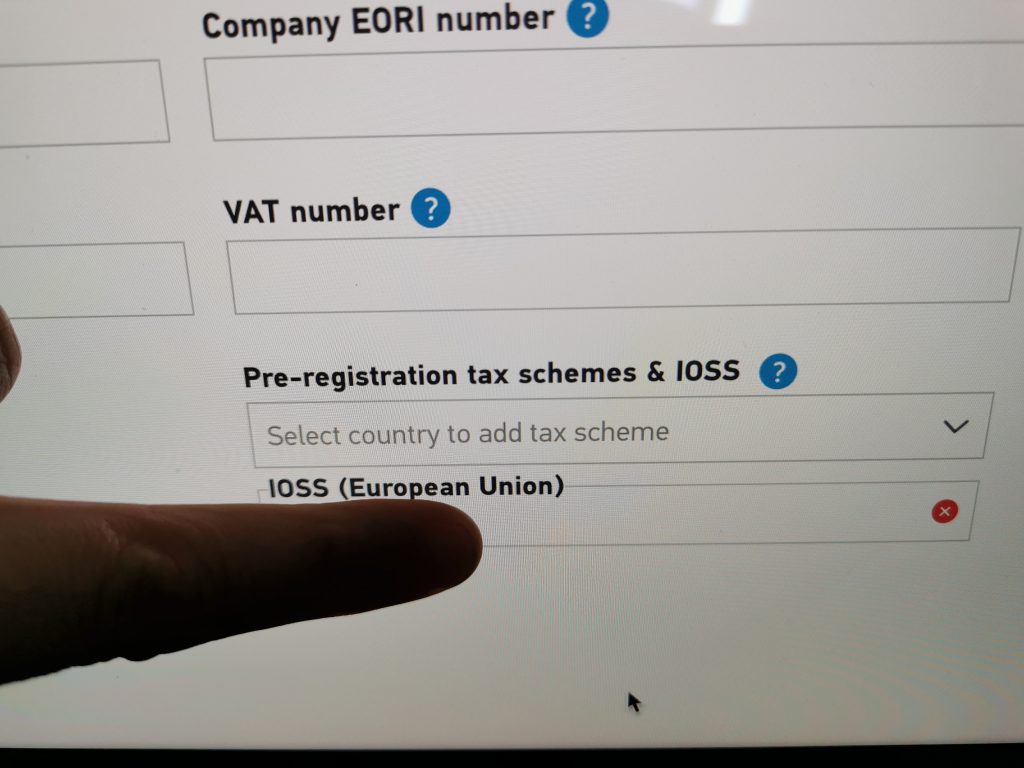

4. Add a new trading name (or amend an existing one if it doesn’t already contain IOSS information you’re using)

5. Click for the dropdown menu in the “Pre-registration tax scheme and IOSS” box and select IOSS (European Union). Add the Bandcamp IOSS in that box (get it from your EU packing slips).

6. Click update in the bottom right corner of the screen and you’re good to go! Just make sure you use the correct Trading Name for the packages you send.

Additional notes

When I added postage to my EU orders I was asked for the IOSS number again in the customs information.

And until I entered the HS code for CDs I couldn’t proceed to checkout and print my documents. HS = Harmonized Commodity Description and Coding System. Every item you send has a customs code, and you can look them up here.

For reference, CDs are HS code 8523414, vinyl is HS code 85238090 and cotton t-shirts are HS code 61091000.

OK, that’s it, I suddenly feel very sleepy – let me know how you get on!

Letterbox Music News Process

Thanks muchly for this. This has been a huge headache for my small indie label. It would appear that some EU countries allow small parcels through with a simple Traxx Stamp noting IOSS number and Marketplace as Bandcamp. But others like Spain are charging VAT and Customs Duty even with that in place. Bandcamp even appear to be unaware of the details you provide here, and they’re actually refunding customers VAT where they have been double charged. Of course, Royal Mail are none the wiser!

What’s interesting is that now with all the additional work and costs to print packing slips and place them in the documents pouches, this is even more work and red tape to jump through than posting items via Royal Mail to the US, Canada or Australia, where items under £20 glide through customs with no cost to the customer. It’s a sad state that Brexit has caused even more red tape than we share with our neighbours across the pond.

Yep, there’s just nothing good about this Stuart!

This is a fantastic and very helpful guide, thank you for work. One thing though, I can’t see the Bandcamp IOSS number listed anywhere on the Bandcamp website. A Google search is also unsuccessful and the Bandcamp support email address seems to have disappeared (their FAQ’s don’t mention IOSS)…

You’re welcome, mono! Bandcamp don’t publish the IOSS number publicly because non-members could just whack it on their own packages in a dodgy fashion, so to get it: go to your orders page, find a relevant order, click “print label” and then choose “packing slips”.

Hi, thanks for the info!

I ship from New York to the EU.

My friends / fans complain about being indeed double taxed on our vinyl sales.

I emailed Bandcamp, 2 weeks in a row, 3 emails, no reply about my IOSS problem.

I did read thru and followed the steps above; per example; i need to send packages to Holland and Poland, but when i click on print label, packing slips ; i only see their name address and order no numbers of any kind.

Any help? Thx Mike

Hi Mike – you’re welcome! That’s strange…ok, here’s a link to an example of a packing slip I have from a customer in France (personal info redacted): https://www.dropbox.com/s/7t8a2gkp3g9hwxp/Screenshot%202021-12-14%20at%2007.48.png?dl=0

See at the top left of the page I’ve selected “packing slips”, underneath just “labels”?

The order totals and the amount of VAT that’s been paid is on the right hand side, and the IOSS number is at the bottom (I’ve covered it up here but it will be visible to you at your end).

If you’re not seeing an amount of VAT taken or the IOSS number, perhaps the VAT hasn’t been taken at checkout. You can check that by finding the email Bandcamp sent you containing the order info. For the example above I’ve got a Bandcamp email saying:

[NAME] just paid £16.00 GBP for:

Exotic Monsters (MBS2106), CD with gatefold artwork, SKU LAKCDEXOMCDXXXXX, by Penfriend, Compact Disc (CD) – £10.00 GBP + 2.00 VAT *

If your email doesn’t say + [amount] VAT that could be because you don’t have “Enhanced Payments” enabled. When I got in touch with Bandcamp to request Enhanced Payments (required for them to collect VAT) Bandcamp replied saying they’d already done that for me ages ago. I don’t know if every account has Enhanced Payments or if you have to request it.

Here’s more information on this: https://get.bandcamp.help/hc/en-us/articles/360007902213-How-do-I-get-paid-on-Bandcamp-

If they’re not collecting VAT for you, then you’ll just have to send the package as it is, and your customer will have to pay VAT at their end. It’s not ideal, because it costs more, but at least if they haven’t paid the VAT to Bandcamp they’re not getting charged twice. Does that make sense?

It’s really crap that Bandcamp aren’t replying to people to help with this! Do let me know if any of this works for you, it’s helpful to know what issues people are having so I can update this article.

Warm wishes, Laura

Hey Laura,

Again, this blog is very helfpul. May I just ask regarding Click and Drop, did you create a new Trading Name called ‘Bandcamp’ using it’s IOSS number in the “Pre-registration tax scheme and IOSS” box? Or do you use your company name in the Trading Name field along your company address and Bandcamp’s IOSS number?

Cheers Stuart

Hi! I just used my company name, but of course you could have a Bandcamp profile, an Etsy profile etc.

Can you still send gifts to EU countries?

Of course! This post only applies to goods you’re selling and exporting to EU countries. If you’re asking whether you can just mark these as gifts to get around this issue, I’d be wary of doing so because your customer may well get charged import etc at the other end anyway, and the main point here is that Bandcamp buyers in the EU have already paid that at checkout.

One question/issue I have in regards to this, that I haven’t found the answer to yet is VAT on physical goods is now being paid twice;

A non-VAT registered musician selling physical products via Bandcamp pays VAT to the supplier/manufacturer- which they cannot claim back as they are not VAT registered – then Bandcamp charges VAT again at the point of sale.

So, for example, a CD with a cost price of £2 is subject to 40p VAT at the point of supply. Then the musician sells that CD for £8.99 to which Bandcamp add a further £1.79 VAT. So the TOTAL VAT going back to HMRC here is £2.19, which is wrong.

It seems to me if Bandcamp are taking responsibility for collecting VAT on the sale of goods, they should also be dealing with the reclamation of the VAT originally paid on those goods at point of supply by the musician/artist.

That’s a really excellent point, Rob!!

There is an answer to that and it’s just to register for VAT voluntarily. Otherwise, yes, HMRC are win-win. Goods with much lower margins make registering for VAT a no-brainer regardless of thresholds. If you take CD manufacture as the only cost, yes, the margin is big so many accept writing off the VAT paid. But if we register for VAT then we can claim back VAT paid on all sorts of expenses beyond just manufacture.

I’ve been registered for VAT as both sole trader and limited company in a past career. It was just about the only part of the accounts I felt I understood and didn’t pass on to my accountant to deal with! Just one form of fairly simple inputs and outputs (don’t know if it’s changed since).

BTW, something I wasn’t expecting as a UK digital-only BC seller was UK orders having VAT added. I don’t think it’s OK to quote a price for a digital album without at least saying ‘exc. VAT’ or ‘plus tax’? That would be a trivial change for BC. Does this mean that digital sales are imports from USA? If so I’m thinking about looking for a UK-based market place for UK sales.

Thanks for posting this Laura. I post my band’s CDs to customers all over the world, and my experiences are similar to yours. As I am not VAT registered I am directing our EU customers to our Bandcamp site, whilst encouraging UK customers to purchase from our own website shop (which also avoids Bandcamp fees). However not everyone follows that advice. I don’t see how to (or would actually want to) prevent EU customers from buying (physical or digital items) from our website.

I’m not sure whether anyone else has come across this issue though, which was reported to me by a customer in Denmark, who was double-charged VAT and customs fees, ending up paying just under £ 38 for a CD that I sold to him for £ 12.

He got sent this expanation “Important: Information for customers who have paid customs duties at the sender (One Stop Shop / Prepaid solution). To ensure that the sender pays VAT and taxes to the Danish Customs, electronic information about One Stop Shop shipments with approved IOSS numbers must always be sent, when your goods leave the country of dispatch. This information (called ITMATT) ensures that the shipments on arrival in Denmark are deducted from customs clearance and sent directly to you.

In cases where approved IOSS customers do not send this information, the shipments will be withheld and you will receive import charges.”

He added “I would assume it is Bandcamp that are responsible for assuring that the ITMATT is in order?”

Has anyone else come across this, and if so is there a solution? How would Bandcamp know when the goods have left the country of despatch? Or to whom to send the ITMATT…?

Hey Brian, thanks for writing! First, I have blocked EU customers from buying anything from my Shopify shop, purely because of the VAT issues. I use an app called Locksmith to do that. I looked into all the different ways round and through this and decided this was, for now, the best way. I have text that comes up on the screen directing people to Bandcamp if they do visit my shop from an EU country.

Second, I would be surprised if Bandcamp would get involved in the ITMATT stuff as they’ve been so offhand and unhelpful about the rest of this. BUT it stands to reason that as they’re collecting the VAT from customers and paying that on in their VAT returns, that there would be some electronic trail. Otherwise, and perhaps more likely, it would be facilitated through using Click & Drop as detailed in this blog post. I haven’t had this issue myself, sending fairly sporadic packages to EU customers over the past few months. I’ve been using Drop & Go, so no electronic info is being sent anywhere, I’m putting the Royal Mail IOSS sticker on the front of the package with Bandcamp’s number on it, and attaching the invoice in a document pouch. I’m not saying your customer is wrong, it might just be that some countries / some depots are doing things that way and some are a bit more relaxed about it and are allowing the sticker / document pouch approach without the electronic aspect. Your comment makes me think I should exclusively use Click & Drop to be more sure there won’t be any issues.

It would be good if this was explained somewhere, wouldn’t it!

PS just to add, it’s illegal to sell digital products direct to people in EU countries if you’re not VAT registered. Just plain not allowed. So that’s why I don’t do it!

Thank you very much for this information it’s very useful. Do I still need to attach/complete a post office customs form? (in addition)

Hi Robin – yes, you do. If you do Click & Drop and print your postage labels yourself, a filled out customs form will print from there. I’ve been using Drop & Go lately, attaching the invoice to the package as detailed in this blog post, and have a roll of customs forms in my merch cupboard to fill out and use as and when.

Hi Laura, I did everything you suggested and they still charged Vat for a package to Germany !

I enclosed documents with the transaction details and filled in the bandcamp IOSS in Click and drop.

I read somewhere that if that happened Bandcamp would refund the Vat to the customer..I’m not sure that is true ?

I’m losing heart and might just have to stop sending merch’ to Europe.

So sorry to hear this, Robin – there are just so many bits where this can go wrong. I would definitely contact Bandcamp and let them know what you did and what happened. Fingers crossed they refund your customer for you. They did say to me they were doing that for people.

Thanks Laura, I will try. I have had some success since writing this but it seems very random when parcels are picked out as “not having the right documentation”

Thanks again so much for your time and effort in trying to help people out. it is much appreciated.

You’re welcome! This whole thing is so frustrating.

Great post!

But your are assuming everybody has “enhanced payment” on BC.

I see the following statement on their FAQ:

“Currently, we’re only offering Enhanced Payments to a small group of artists and labels.”

And later:

“For artists or labels using Standard Payments (where Bandcamp does not serve as the payment processor, and the payment from the fan is made directly to the artist’s PayPal account), the artist or label is responsible for processing any applicable taxes or customs related to the sale of merch.”

Unfortunately I do not have “Enhanced Payment” on my account. And as far as I understood, I can’t apply or pay to have it.

Or am I missing something here?

Hi! I’m assuming nothing I didn’t realise I had enhanced payments on my account until 1) I read that I needed it for Bandcamp to collect the VAT, 2) I emailed Bandcamp to ask them about it and 3) they replied saying I already had it. I think it’s likely they add it onto anyone’s account who’s making sales to EU countries but all you have to do is send Bandcamp an email and ask them to add it to your account if it isn’t on already.

I didn’t realise I had enhanced payments on my account until 1) I read that I needed it for Bandcamp to collect the VAT, 2) I emailed Bandcamp to ask them about it and 3) they replied saying I already had it. I think it’s likely they add it onto anyone’s account who’s making sales to EU countries but all you have to do is send Bandcamp an email and ask them to add it to your account if it isn’t on already.

So for those of us with Standard Payment accounts, if we’re adding merch / physical releases to our bandcamp page: what do we answer when faced with the “charge % or do not charge VAT” option?

(BTW thank you so much for all the effort you made Laura. I just want to sell a few physical releases and you have made what was a bit of a minefield a little more approachable!)

-BC

Hi Blake! If you’re not VAT registered you should never charge VAT.

I have downloaded the sales sheet from Bandcamp but none of the headings say IOSS.

Is it called something else like ‘paypal transaction id’.

Where is the IOSS? Thank you in advance! xx

Hi MC – go to your orders page, find a relevant order, click “print label” and then choose “packing slips”. You’ll find the IOSS number on that document.

Laura, I have previously located and used the Bandcamp IOSS. However since Feb 2023 German Customs are stating that the number has expired. As such I have 30+ orders being held in a German processing centre until I can provide a new number.

Also, despite following your instructions to the letter the packaging slip does not contain an IOSS.

Hi Phil – yes, Bandcamp changed their number recently.

Go to:

Orders

Print label

Under “Print type” – click Packing Slips – then generate PDF to print. The IOSS number is on that document under Shipping / Tax / Total

The only reason I can imagine this isn’t showing up for you would be if you don’t have “enhanced payments” set up on Bandcamp – if this is the case, you need to email their support to get that added.

Some excellent info here. But a couple of points.

1. customers having to pay VAT (again?) to receive the goods is not that bad if it’s a single CD or vinyl – perhaps a few Euro. But…this is accompanied by a “customs processing fee” which is generally around €20 (e.g., here in Belgium it’s €18). That basically doubles the cost.

2. As mentioned, be VERY careful of marking the goods as a “gift”. The €45 limit is still in place but to qualify as a gift there has to be no financial transaction between the sender and receiver. You MIGHT get away with it when sending a CD in a little envelope. But a vinyl, in a proper 12″/30cm packing? Very doubtful. And it’s illegal. German Customs are in any case hot on all customs issues. And I’ve had several parcels seized by Belgium Customs despite being marked as “gifts” and valued below €45 – which I’ve then had to prove were genuine gifts – which, I hasten to add, they were).

Side note (with pedant hat on)…in fact, the rules were changed before Brexit. A few years back the EU (when the UK was still in it) decided that (a) because on-line sales had increased so massively in recent years, and (b) because there was so much VAT fraud with parcels (especially from China) being undervalued – exacerbated by the fact that postage costs from China are so low – that it was missing out on huge amounts of VAT. It therefore decided to remove the “low value consignment” exemption of €21 (for VAT – the €150 for customs duties is still in place – for the moment…). The UK implemented this change (with the effect coming into place July 2021) before Brexit. So, Brexit has meant the change affects UK-EU sales, but the change was not because of Brexit.

Thanks for adding to this, Stuart – very helpful!

To add further insult to injury: The IOSS number _only_ apply to EU members, for someone like me.

The 2nd EU Tax directive is not implemented in EEA countries (Norway/Iceland/Switzerland/Liechtenstein) and others.

For Bandcamp sales to Norway, use the Bandcamp VOEC number in place of the EU IOSS number. All else applies as above.

I don’t know how many records I have paid double VAT for, because sellers have used the IOSS number (as if Norway was a member country). Bandcamp charges, reports and pays EU VAT, Norwegian Customs add 25% Norwegian VAT on top of total value — including 25% “EU” VAT.

So, I am not just paying VAT twice, I’m paying VAT on VAT!

If only the UK and Norway could have been part of EU, all would have been way

Johan – this is brand new information to me, thank you! Do you know where to find the Bandcamp VOEC number please?

Same place. On the packing slip.

Doh yes of course, thank you Dave!

I’ve got the IOSS number, established that vat has been paid, got the documents enclosed and packing slips ready. I’ve put every detail into click and drop, paid for 30 labels and with the pdf I also get CN22b forms.

Do I still need the CN22 form if the click and drop barcode contains all the information? My problem ( amongst many ) is that there isn’t enough space on the packages for everything.

I wouldn’t know, I’ve only used C&D a couple of times and always put the CN22b forms on as well. It would just be annoying if there were more issues arising from not putting them on!

In the end I stuck the documents enclosed label on the back of the package, tucked the Bandcamp packing slip inside it and the CN22b form on top of that, so that it showed through the window, and sealed it. The Post Office were adamant that the CN22b form needed to be on there and should take priority over proof of tax paid. Fingers crossed everything is delivered without issues.

And thank goodness for this blog post, cannot thank you enough.

This is a really helpful article, thanks so much for researching and writing. Would it be possible to do an update (or comment) for 2023 when getting on Bandcamp’s Enhanced Payment system isn’t possible please?

I understand why you’d ask, but I’m not an expert in Bandcamp or VAT – I get no response from them when I ask for help so just cobbled this together a while back. I don’t see how I’d be able to get the extra info to update it, sorry to say.

Hi I am just a customer but still found this very interesting.

I have had a couple of messages from bands/labels directing me to their alternative webstores but a big plus for me with bandcamp is the download.

I play vinyl and ipod. No streaming.

Now that download cards are no longer a consistent feature of vinyl releases, Bandcamp is often the best place to buy.

You are angel

Thanks for this article. So glad I stumbled upon it. Everything explained perfectly – with pictures!

Had to send some music from Manchester to Berlin via Bandcamp, was sweating about how to do it before I read you.